Can an FSA or HSA be used for insurance premiums?

In most cases, the pre-tax dollars in a flexible spending account (FSA) or health savings account (HSA) cannot be used to pay for health insurance premiums. This applies to any type of insurance policy (HMO, PPO, etc.) associated with the account.

An eligible expense usually needs to be medical care (including medication and equipment) that helps or prevents a physical or mental defect or illness. This includes vision and dental care.

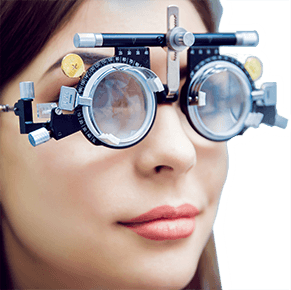

Vision expenses covered by an FSA or HSA include prescription eyeglasses, sunglasses, contact lenses and reading glasses, along with eligible services like eye exams.

SEE RELATED: What is the difference between an HSA and an FSA?

With an FSA, health insurance premiums are considered a non-medical expense and are not allowed.

Paying for health insurance premiums with an HSA would be considered a non-medical withdrawal. Non-medical withdrawals are subject to any applicable taxes plus a 20% penalty fee from the IRS.

When an HSA can be used to pay for health insurance premiums

There are a handful of exceptions to the penalty for using a health savings account to pay for premiums. In most cases, you can use HSA funds to pay for the following premiums:

Qualified long-term care insurance.

Health coverage while you are receiving federal or state unemployment compensation.

Continuation of health insurance coverage as required under federal law, such as COBRA.

Medicare (for those 65 or older).

In other situations, taxes will apply, but the 20% IRS penalty will not apply to the non-medical HSA withdrawal. These can include the following conditions:

The account holder is 65 years old or older.

The account holder is permanently disabled.

The account holder has passed away.

Be sure to check with your provider or employer to make sure payments are covered under your plan. For up-to-date information on how the IRS classifies eligible medical expenses, long-term care and programs like COBRA, please visit IRS.gov.

READ MORE: Is vision insurance worth it?

Page published on Wednesday, September 4, 2019