What is covered by vision insurance?

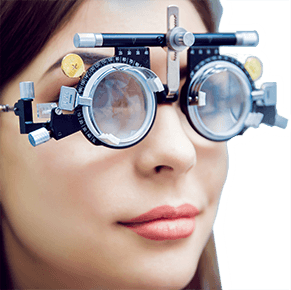

Vision insurance and vision benefits plans typically cover the cost of an annual eye exam and prescription eyeglasses and/or contact lenses.

Vision insurance encompasses both traditional health/medical policies and wellness/discount plans that offer vision benefits that cover most, but usually not all, of the insured’s expenses. Coverage will vary depending on the type of vision insurance policy or vision benefits plan you choose.

Group vision insurance usually is available through an employer, professional association, or through a government program such as Medicare or Medicaid. If you do not qualify for any of these options, you can purchase an individual vision care plan from a vision insurance provider.

Items covered by vision insurance

Generally speaking, vision plan coverage is limited to specific benefits and discounts in exchange for an annual fee and possible copay. The scope is usually narrower than that of vision insurance offered as part of a major medical health insurance policy through an employer or other entity.

Some basic vision benefits are included in all policies and plans. These basic vision benefits typically include routine preventive eye care, including eye exams and prescription eyewear like eyeglasses and contact lenses.

More comprehensive plans and policies expand coverage to include specialty options like eyeglass lens coatings and enhancements, such as anti-reflective coating, photochromic lenses and progressive lenses. These eye care plans and policies may also offer discounted rates on elective vision correction surgery like LASIK and PRK.

Know what's covered by your vision insurance plan

Whether your vision insurance is included as part of your health insurance benefits from your employer, or you are purchasing an individual vision care plan, it’s a good idea to familiarize yourself with the specifics of the coverage included in the plan. Costs and benefits will vary depending on your vision insurance plan.

Before using your vision insurance, use our locator to find an eye doctor near you who takes VSP, EyeMed and other popular vision insurance options. When you call your eye doctor, confirm the specific benefits available to you as well as any out-of-pocket payments that are your responsibility.

If you have a health savings account (HSA) or flexible spending account (FSA), those funds usually can be used to pay costs (such as higher-end eyeglasses or prescription sunglasses) not covered by your vision insurance or benefits plan.

SEE RELATED: Does vision insurance cover virtual visits?

Page published on Thursday, May 23, 2019